UK adspend rose 4.2% to reach £6.0bn in the first quarter of this year, with online radio ad expenditure growing a massive 26.5% year-on-year, according to new research.

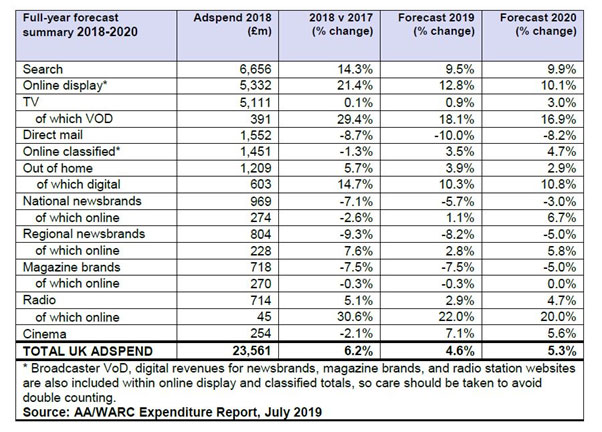

The AA/WARC Expenditure Report covers all major media and ad formats, includes adspend by product category and quarterly data going back to 1982 along with projections for the next two years.

Key findings:

- Overall growth for 2020 is predicted to reach 5.3%.

- Total online display, which includes broadcaster video-on-demand, saw growth of 16.6%.

- Online radio advertising expenditure grew by 26.5% year-on-year.

- Growth is predicted for the majority of advertising formats across 2019, with online radio and video-on-demand forecast to see the most significant gains (22% and 18.1% respectively).

Q1 2019 marks the 23rd consecutive quarter of market growth and covers the three-month period leading up to the original scheduled Brexit date of March 29, 2019. It comes as the government has indicated it will spend a reported £100m on advertising to prepare business for a no-deal Brexit ahead of the next scheduled departure date of Oct 31.

“We hope that the new administration can deliver a business-friendly outcome to our relationship with the EU, ensuring the UK’s domestic advertising market remains robust and our advertising exports, which are world-class, keep growing,” said Stephen Woodford, Chief Executive at the Advertising Association.

The report forecasts growth to £24.6bn for 2019, equivalent to a 4.6% annual increase, with the UK’s ad market expected to grow a further 5.3% in 2020.

The figures highlight growth coming from areas including search, online display, TV VOD, online radio, out-of-home and cinema.

Online advertising expenditure performed notably across a number of formats, with online radio seeing standout year-on-year growth of 26.5% in the first quarter. TV VOD achieved an increase of 17.5% in the same period, while total online display saw an increase of 16.6%. Digital out of home also experienced a good Q1 with growth of 10.9%.

Across traditional formats, cinema saw strong growth of 12.3% in Q1 2019 versus Q1 2018, making it the second-fastest growing medium overall.

Growth is forecast for 2019 across the majority of formats, with the greatest increases predicted in digital ad formats for radio broadcasters and broadcaster video-on-demand (BVOD).

But these projections are dependent on the emerging political climate. “As before, we have assumed that the UK will leave with a deal in place and that the worst-case scenario recently outlined by the Office for Budget Responsibility, with the economy entering a recession next year, will be avoided”, the report states.